Borrow 50000 mortgage

But its not as simple as deciding how much you want you should really be focusing on how much you can realistically afford to pay back. How to use our 50000 repayment calculator.

How And Where To Find Small Mortgage Loans Lendingtree

How much will a 50000 loan cost with interest.

. 50000 650 to 1650 Boat Motorhome and Travel Trailer Loans Used 2012 to 2020. 3 25bp discount for loans set up with monthly automatic payments from RCB deposit account excludes HELOC products. Will not owe income tax or penalty.

Borrow more on your NatWest residential mortgage to help realise your plans for those home improvements dream holiday etc. Borrow from her 401k at an interest rate of 4. This is the amount youre looking to borrow.

How To Use Cash App Borrow. The actual cost of a 50000 personal loan depends on factors such as your interest rate repayment terms and fees. This means you could afford a home worth 220000 the 170000 you can borrow plus the 50000 youve saved.

We welcome your comments about this publication and your suggestions for future editions. Imagine that instead of buying a more expensive home you bought one worth 178950 paid the full 50000 youve saved as a deposit and borrowed. How much you can afford to spend on a home in Canada is primarily determined by how much you can borrow from a mortgage provider.

Use the mortgage affordability calculator above to figure out how much you can afford to borrow based on your current situation. Borrow from the bank at a real interest rate of. These factors vary by lender.

Mortgage rates shown are based on a 60-day lock for rate and term refinance transaction for of a primary residence. A bank is a financial institution that accepts deposits from the public and creates a demand deposit while simultaneously making loans. You can borrow a minimum of 5 and a maximum of 20 40 in London of the propertys full price.

The annual percentage yield is a percentage rate that reflects the total amount of dividends to be paid on an account based on the dividend rate and frequency of compounding for an annual period. For additional funds you can borrow up to current value of the home known as cash-out refinancing Enter in a dollar amount between 50000 and 1000000. Mortgage calculators can be useful to get a rough idea of your total borrowing but keep in mind that they are unable to take into account your personal circumstances and therefore there may be additional factors that affect the actual amount you can borrow.

That is unless you have enough cash to purchase a property outright which is unlikely. Loans up to 50000 max term 6 years for new cars 2021 model year. 401k Withdrawal of Any Amount.

You could potentially in some circumstances borrow up to a maximum of 90 of the value of your home. 50000 or greater. Find out how to get a second mortagage with our guide.

Large 401k Loan Limited to Half of Balance or 50000 Whichever Is Smaller. 30-day lock for purchase transactions. The RBA effectively pushes fixed mortgage and term deposit rates lower.

But with so many possible deals out there it can be hard to work out which would cost you the least. The best opinions comments and analysis from The Telegraph. Paying a bigger deposit can also get you a cheaper mortgage.

50000 maximum borrowing amount 2000000 type of mortgage Variable. A second mortgage is a separate mortgage taken out on an additional or second property. Our experienced journalists want to glorify God in what we do.

The standard rule is that a couple can deduct the interest paid on up to 100000 in home equity loan debt and a single filer can deduct the interest on up to 50000. You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. NW IR-6526 Washington DC 20224.

Check for the word Borrow If you see Borrow you can take out a Cash App loan. To achieve a 41 DTI with a 50000. Want to borrow more or less than this.

Guidelines for home equity loan tax deductions. You can use our loan calculator to compare a range of 50000 loans from popular lenders based on monthly payment size and APR. Lending activities can be directly performed by the bank or indirectly through capital markets.

Tap on your Cash App balance located at the lower left corner. The following table should help you see roughly whos likely to pay their loans off and what the total cost will be. Tap on Borrow Tap Unlock Cash App will tell you how much youll be able to borrow.

So for many people what they borrow is irrelevant theyll just keep paying monthly until the debt is scrubbed after 30 years. American Family News formerly One News Now offers news on current events from an evangelical Christian perspective. Theyre fairly uncommon though and found in only a few states.

2 Used vehicles - maximum of 80 of Purchase Price or NADA blue book value whichever is less autos with model years not older than 5 years - currently 2016. Mortgage Payment Protection Insurance MPPI MPPI provides longer mortgage protection for 12 months up to 2 years depending on your policy. So the more you borrow the higher the tax.

Because banks play an important role in financial stability and the economy of a country most jurisdictions exercise a high degree of regulation. Go to the Banking header. Our mortgage calculator helps by showing what youll pay each month as well as the total cost over the lifetime of the mortgage depending on the deal - you just need to input some basic info such as interest rate and fee size.

You may be able to buy a home on 50000 a year with todays low interest rates and special mortgage programs. The more youre allowed to borrow. Simply enter how much you want to borrow how long you want the loan for the value of your property and mortgage then well find you the loan that could best suit your situation.

This is one reason why talk of 50000 debts is nonsense for most. Her cost of double-taxation on the interest is 80 10000 loan x 4 interest x 20 tax rate. Monthly payments can be large and substantially affect mortgage qualification.

Your insurance provider covers 125 of your mortgage. It leaves you with two concurrent mortgages to pay off. An experienced mortgage broker on the other hand will be able to create a bespoke.

As a requirement you must make a 5.

Example Of A Property With A Good Cash Flow Return Green Label Positive Cash Flow Cash Flow Statement Cash Flow

4 Personal Loan Lenders That Ll Give You As Much As 50 000

I Make 50 000 A Year How Much House Can I Afford Bundle

How Much House Can I Afford Forbes Advisor

450k Mortgage Mortgage On 450k Bundle

Meidan Nettisivumme Https Pikalaina Org Lainaa Edullinen Pikalaina On Suosittu Lainanvalityspalvelu Netissa Kiinnostuitko Ilmaisesta Pikavipista Lainaa 60th

Will A Mortgage Lender Check Where A Deposit Has Come From Sterling Money Pound Sterling Money Notes

How To Find Small Home Loans Under 50k Gobankingrates

4 Smart Ways To Use Your Home Equity And 4 Risky Options To Avoid Mortgage Loan Calculator Refinance Mortgage Mortgage Payment Calculator

How To Get A 50k Personal Loan Upstart Review Youtube

How To Get A 50 000 Personal Loan Bankrate

50k Loans 50 000 Loans For Good Or Bad Credit Acorn Finance

Bi Weekly Loan Calculator Biweekly Payment Savings Calculator

Personal Loan War Heats Up As First Direct Raises Limit To 50 000 Borrowing Debt The Guardian

Pin On Cadabra Mobile

Luks Para

/MortgateRates.Fed.StL-0099d59e398e4f239bc0cc4154e04cb7.jpg)

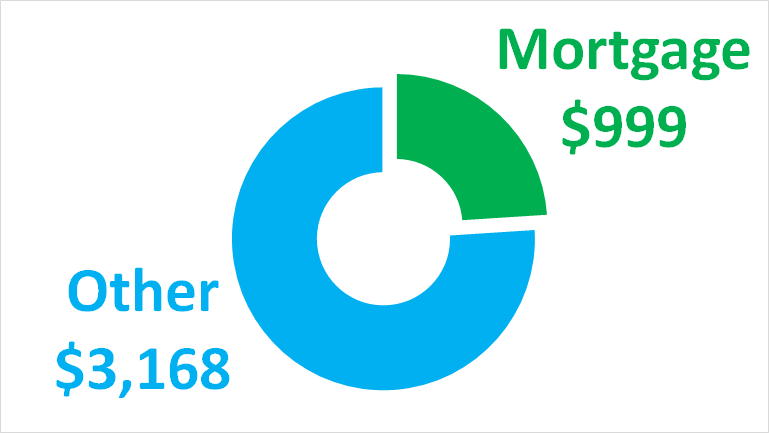

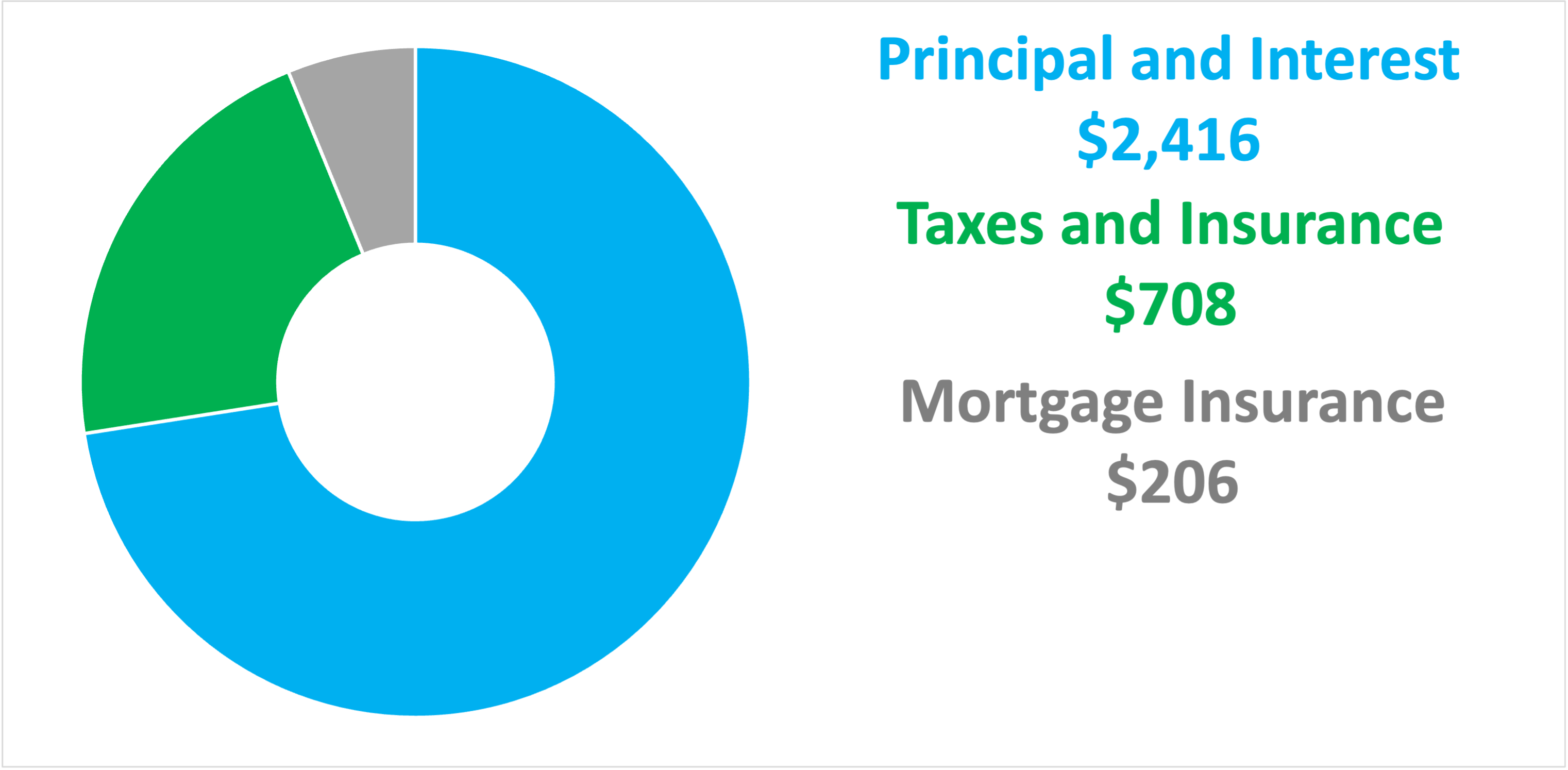

Mortgage Calculator